Services

All Online Loans Services

PMEGP Loan

PMEGP is a central sector scheme administered by the Ministry of Micro, Small and Medium Enterprises (MoMSME). The scheme is implemented by Khadi and Village Industries Commission (KVIC) functioning as the nodal agency at the national level. At the state level, the scheme is implemented through State KVIC Directorates, State Khadi and Village Industries Boards (KVIBs), District Industries Centers (DICs), and Coir Board, known as the Implementing Agencies.

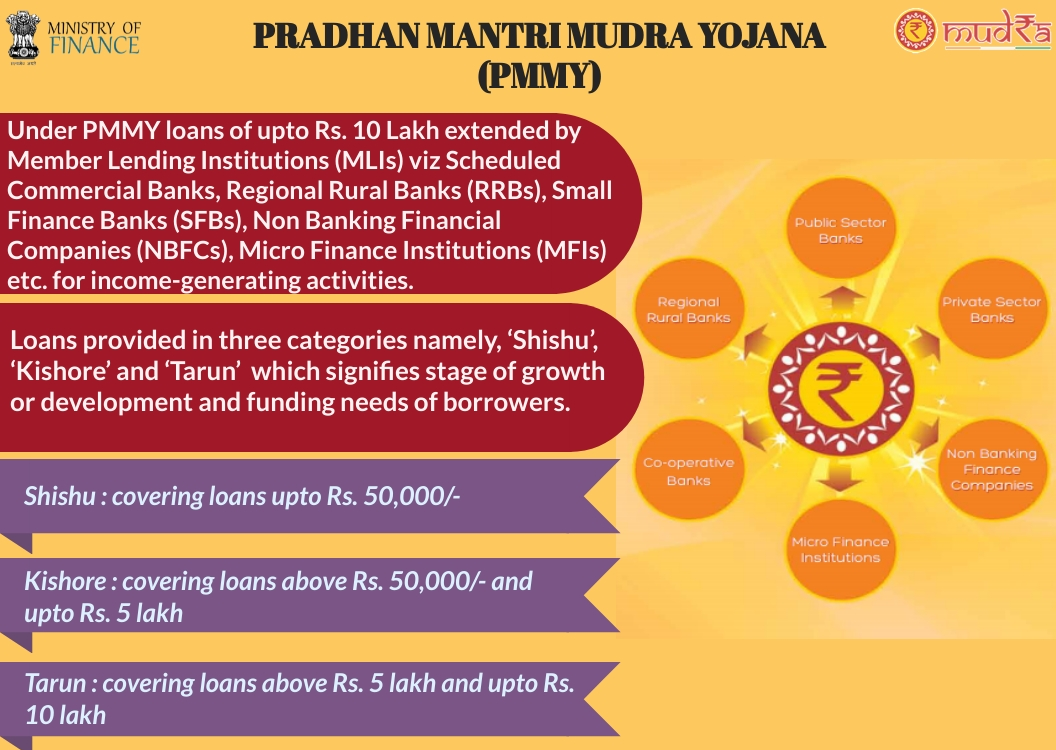

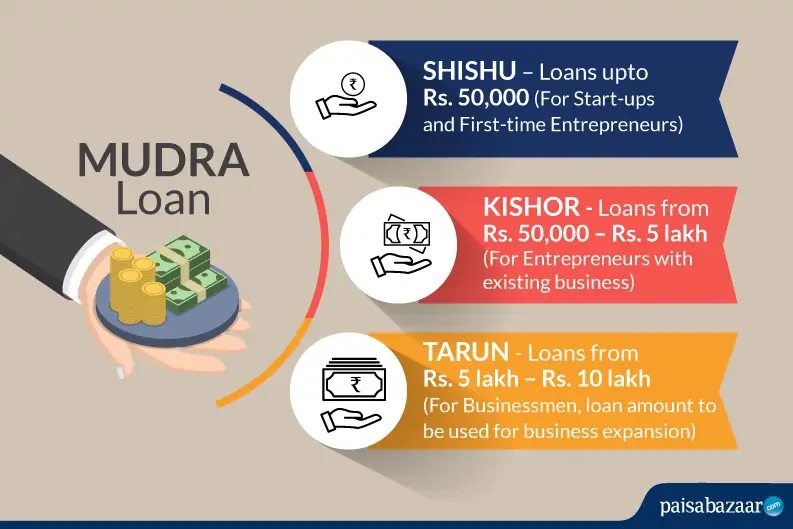

Mudra Loan

Household Emergency Loan Loans To Meet Your Financial Commitments Loans For Urgent Medical Emergency Loans For Travel And Leisure Loans For Immediate Purchase And Shopping Loan To Clear Your Pending Bills Short Term Loan No Pre-closure Charges

Instant Personal Loan

A personal loan is an unsecured loan used to address various financial requirements. A personal loan can be obtained for several reasons including wedding expenses, home renovations, vacation expenses, education fees, or medical emergencies

Business Loan

A business loan is a type of loan designed for commercial uses, like expanding your business, acquiring long-term assets, or fulfilling short-term capital needs. It should be reimbursed according to the established conditions and agreements

Loan Online

Rapid Fund Provider is one of the most trusted bank loan consultants in India. We are associated with all major Banks and NBFCs. We act as intermediaries between lending institutions and borrowers. We solicit loans, represent creditors to borrowers, and represent borrowers to creditors.

Rapid Fund Provider provides comprehensive solutions and guidance to all financial needs. Whether you are salaried, self-employed, or a retired person, our in-depth domain expertise is capable of meeting your extensive requirements within a specific stint.

EVERYTHING YOU NEED TO KNOW

Our sole vision is to attain the best standards and become India’s top financial consulting company.

Our mission is to work with intensity, dedication and innovation to achieve excellence in service. Digital Finance is committed to client safety, client secrecy, and data confidentiality.

Our consultants also provide doorstep services.

INSTANT LOAN

Individuals might need immediate money at any moment. Whether it’s distant wedding costs, unanticipated expenses, funding your aspiration, vacation, or a health crisis. Instant loan helps you to address various financial needs or emergencies. An instant loan is an unsecured loan that is granted solely on the borrower’s creditworthiness without requiring any collateral as security. It is incredibly smooth with a digital and effortless experience

Required Documents

- Financials: Salary slips of the last three months.

- Bank account statements: Salary account bank statement of last six months.

- Employment Proof: Employee ID Card.

- Identity Proof: Passport/ Voter Card/ Driving License/ PAN Card

- Address Proof: Passport/ Driving License/ Ration Card/ Letter from employer (with HR undersigned)/ Latest electricity bill.

Personal Loan

Personal loan is an unsecured loan that you can take to meet unspecified financial needs. A personal loan can be availed for various purposes such as wedding expenses, home remodeling, vacation costs, paying education fees, or medical emergencies.

Personal loans are approved and disbursed on the basis of key criteria such as employment record, income, and borrower’s creditworthiness.

Documents required for Salaried Individuals

Identity proof: Passport/ Voter Card/ Driving License/ PAN Card

Address proof: Passport/ Driving License/ Ration Card/ Letter from employer (with HR undersigned)/ Latest electricity bill.

Income details: Last 3 months’ salary slips/certificates, Salary account bank statement for last 6 months, Form 16 (TDS certificate)/ Income Tax Return of last 2 Years.

2 passport sized photographs.

Eligibility criteria for Personal loan: The eligibility criteria for a personal loan may differ from one lending partner to another, the following are some of the basic eligibility criteria applicable to personal loans for salaried individuals.

Age limit: 21 years to 60 years.

Minimum income: The minimum net monthly income criteria set by most of our lending partners for salaried individuals is ₹15,000.

Minimum total work experience: 1 year.

Minimum work experience with the current organization: 6 months

Credit score: 700 or above

Maximum loan amount: Most of our lending partners provide a loan of up to ₹15 lakh.

The minimum Annualized Percentage Rate (APR) is 9.75%

The maximum Annualized Percentage Rate (APR) is 24%

The interest rate varies based on your risk profile.

Minimal and maximum repayment period : 12 months to 60 months.

Entire repayment in 30 days or less is not allowed.

Our lending partners also charge a processing fee; that needs to be paid to get the loan processed and is usually 1.5%-2.5% of the loan amount.

Representative example:

Consider a Personal Loan of ₹1,00,000 at an interest rate of 9% per annum for a tenure of 12 months.

Processing fee is 2% of the loan amount = ₹2,000 + GST = ₹2,360

Line setup fee of ₹499 + GST = ₹588 to be paid before starting the credit line.

Then, the total interest payable is ₹4,942

The total amount payable is ₹1,04,942

The EMI will be ₹8,745

BUSINESS LOAN

Micro and small businesses provide significant economic advantages and create jobs for families in rural areas. Nonetheless, they require limited access to resources from banking and financial sectors that could help them enhance their business. The micro-enterprise loan is available for small and micro-enterprises. It will be utilized from the section of our application form. This small bank loan offers one of the most straightforward MSME loan interest rates in comparison to informal funding options. It provides fantastic benefits such as borrowing without any collateral and minimal collection thresholds

You are eligible for a Business Loan if you are either of the following:

- Limited or Private Limited Company

- Partnership or Proprietorship Firm

- Chartered Accountant / Self Employed professional

Documents required for Business Loan:

- Application form

- 1 Photograph of co-applicant

- Income Details: IT returns, Balance sheet & P/L account statement for the last 2 years with Annexure, Form 16 A

- Bank account statements for the last 3 months

- KYC documents of co-applicant

- Business vintage for 5 years

HOME LOAN

Buying a house is currently easier than ever. Our home equity loan offers you the most effective interest rates on housing finance and a good choice of property, so you’ll be able to live your best life. Apply for a home loan online with us and avail of our low EMI option and fast process facility. Once you have applied, you can even track your loan status. What is additional? we’ve got also dilated our criteria to form them more accessible. you furthermore might get the choice to effortlessly transfer a home loan if you’ve got an existing one. So, come, sleep in your dream home with us.

Products Portfolio

- Loan against commercial property

- Loan against residential property

- Loan for purchase of commercial property

- Loan against plot

- Lease rental discounting

Documents required for Loan against property:

- Application form, Photograph, Identity Proof, Address proof, Signature Proof, Date of Birth Proof, IT Returns & Balance Sheet & P/L Account statement for the last 2 years. Business Continuity Proof for 5 years. Bank account statements for the last 6 months. Copy of property paper to be mortgaged.

STUDENT EDUCATION LOAN

Education loans aim at providing funding to worthy/meritable students for following educational activity in the Republic of India associated abroad. With an array of services to decide on from and simple compensation options, we make positive you get complete monetary backing.

- The student applying for an education loan must be an Indian Citizen and 18 years old or above.

- There must be confirmed admission in the Institute before final disbursement of the education loan

- The student loan must be co-signed by an earning co-borrower in India.

Co-Borrowers

- The co-borrower of the abroad studies loan must be an Indian Citizen and could be a Parent, Sibling or Legal Guardian.

- The co-borrower must have a bank account in any bank in India with chequebook facilities.

- The co-borrower would necessarily be the primary debtor.

Documents Required for Student Loan

- Student KYC & Educational documents, Course fee details, Co-Borrower KYC & Income documents, Collateral documents

PMEGP LOAN

Prime Minister’s Employment Generation Program (PMEGP)

MSME/MUDRA/PMEGP YOJANA LOAN

PMEGP is a central sector scheme administered by the Ministry of Micro, Small and Medium Enterprises (MoMSME). The scheme is implemented by Khadi and Village Industries Commission (KVIC) functioning as the nodal agency at the national level. At the state level, the scheme is implemented through State KVIC Directorates, State Khadi and Village Industries Boards (KVIBs), District Industries Centers (DICs), and Coir Board, known as the Implementing Agencies.

Benefits of PMEGP

1. Bank-tinanced subsidy program for setting up new microenterprises in non-tarm sector

2. Margin Money subsidy on Bank Loan ranges from 15% to 35% for projects up to Rs. 50 Lakh in manufacturing and Rs. 20 Lakh in the service sector

3. For beneficiaries belonging to special categories such as SC/ ST / Women/ PH/ Minorities/ Ex-Servicemen/ NER, the margin money subsidy is 35% in rural areas and 25% in

uran areas.

Eligible Applicants

1. Any individual, above 18 years of age is eligible

2. There will be no income ceiling for assistance for setting up projects under PMEGP

3. No Educational Qualification is required for project cost up to 10 Lakhs for manufacturing and up to 5 Lakhs for service sector

4. Beneticiaries should possess at least VIll standard pass educational qualification tor setting up of project costing above Rs. 10 lakh in the manutacturing sector and above Rs.

lakh in the business /service sector

(i) Self Help Groups (including those belonging to BPL provided that they have not availed benefits under any other Scheme)

(I) Institutions registered under Societies Registration Act, 1860,

(ill) Production Co-operative Societies, and

(iv) Charitable Trusts are also eligible for assistance under PMEGP.

5. Existing Units (Under PMRY, REGP or any other scheme of Government of India or State Government) and the units that have already availed

Government Subsidv under any othel

scheme of Government of India or State Government are not eligible